The global tire industry has seen continuous growth in sales and revenue in the last decade. This has been a result of various factors.

Some of these factors include; vehicle technological innovations, economic conditions, and the constant change in consumer choices.

A critical examination of regional market distributions and major players in the industry is a necessity. It provides deep insights into the forces impacting sales trends.

What more? It’s also vital to consider the impact of other factors such as; vehicle types, materials and design changes, and the evolution of autonomous and electric vehicles.

All the sales and revenue values in this article are in US Dollars.

Table of Contents

Tire Market Key Statistics

Here are some of the key statistics of the current tire market size:

- Overall, COVID-19 didn’t pose a negative effect on the tire market. The market size continued to increase during the pandemic despite disruption in tire import and export worldwide.

- The tire market size was $112.16 billion in 2019 and became $116.73 and $126.44 billion in 2020 and 2022, respectively. This shows continuous growth during the pandemic.

- A total of 2,388 million tire units were produced globally with a market size of $134.62 billion in 2023.

- The global tire market is expected to reach $176 billion in 2027.

- The eco-friendly tire market size was $33.68 billion in 2023 and is projected to reach $86.1 billion by 2033.

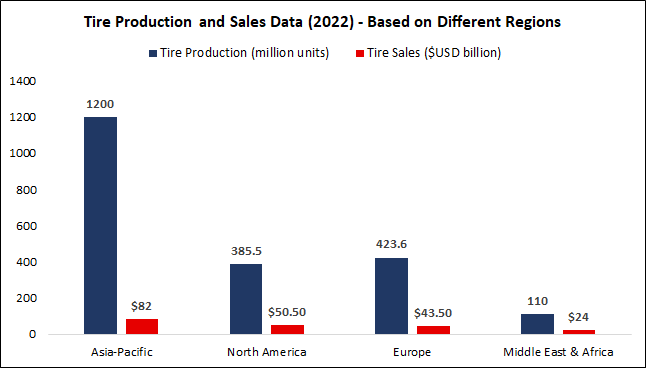

- The Asia-Pacific is the largest and fastest-growing tire market globally. Approximately, 1,200 Million tire units were produced in 2022 with a value of $82 billion. The market size is expected to grow at a CAGR of 4.5% up to 2028.

- North America is the second largest tire market with a total production of 385.5 million tire units and a sales revenue of $50.5 billion in 2022.

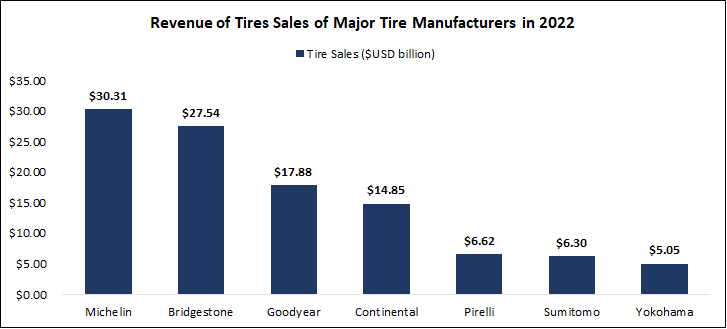

- Among the major tire manufacturers around the globe, Michelin stands at the top with total tire sales of $30.31 billion in 2022. Bridgestone and Goodyear are the second and third largest tire manufacturers respectively, in terms of revenue.

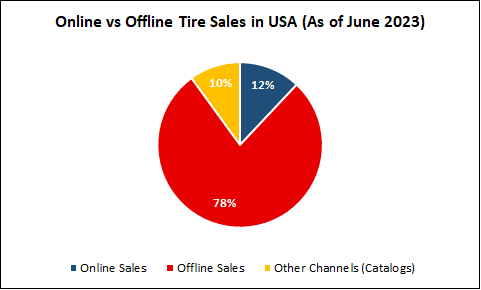

- North America’s online tire market is the largest and most established. During the first half of 2023 in the United States, online tire sales accounted for 12% while offline sales were 78%.

Global Tire Market Size And Growth And Future Outlook

The global tire market’s growth skyrocketed in the last 10 years. We noticed a high demand for vehicle tires due to emerging economies and a quantum leap in vehicle sales. Additionally, tire technology advancements also influenced the expansion of the industry.

It’s vital to note that the tire industry has also encountered some challenges in recent years. The major challenge is the outbreak of the COVID-19 pandemic. The pandemic altered supply chains and caused a temporary setback in the export of tire raw materials.

However, this didn’t affect the tire market size negatively. The tire market size which was at 112.16 in 2019, saw an increase during the peak of the pandemic in 2020-22. It reached $116.73 billion in 2020 and became $121.49 and $126.44 billion in 2021 and 2022 respectively.

Meanwhile, the global tire production was around 2,388 million tire units in 2023 with a market size of $134.62 billion.

Based on the forecast, the global tire market is projected to experience continuous growth until it attains approximately 3,012 million units in 2032. Also, its global market size is expected to hit over $176 billion by 2027.

Meanwhile, we’ve observed a key trend, which is the rise in the demand for eco-friendly and hybrid vehicle tires. These tires offer reduced rolling resistance, which results in improved fuel economy and minimal carbon emissions.

The strict government regulations on emissions based on the growing environmental concerns are the major drivers behind this trend.

The green (eco-friendly) tire market size was $33.68 billion in 2023. The market value is anticipated to hit $86.1 billion by 2033. This result will be accompanied by a 9.7% CAGR between 2023 and 2033.

In addition, there have been some shifts in the global tire market share region-wise. Emerging markets like Asia-Pacific, particularly China, become a major contributor to the market’s growth. The rapid urbanization and increasing disposable incomes in this region have consistently contributed to higher vehicle demand. This has affected the tire industry’s expansion in turn.

Diving into the Regional Market Distribution

In recent years, we’ve seen significant shifts in tire sales trends in the global market. However, let’s take a moment to explore the regional market distribution. This will reveal how different areas contributed to the overall changes.

Asia-Pacific

The Asia-Pacific region stands at the forefront when it comes to growth in global tire sales. For instance, China, Japan, India, and Indonesia experienced significant growth particularly due to their rapid automotive market expansion.

In China, the expanding middle class has triggered a high demand for vehicles, impacting the need for more replacement tires. Talking about Japan, this country continues as a top global vehicle producer, resulting in tire sales locally and internationally.

The Asia-Pacific tire market size attained 1,200 Million Units in 2022, having an estimated sales revenue of $82 billion.

Additionally, the market is expected to hit 1,550 Million Units by 2028. This depicts a CAGR of 4.5% during 2023 – 2028. Meanwhile, it is vital to note that China ranks as the biggest tire market in Asia.

North America

In the last decade, North America (the United States, Mexico, and Canada) experienced consistent growth in tire sales. The persistent development of the region’s automotive industry and increased demand for replacement tires are major determinants of its performance.

The increasing use of SUVs and trucks in North America has also impacted the demand for heavy-duty tires. The North American market size hit 385.5 million units in 2022. The tire sales value was estimated at $50.5 billion.

It is anticipated that the North American market size will attain 455.0 Million Units in 2028. This depicts a 3% growth rate from 2023 to 2028.

Europe

Europe’s vehicle tire sales have been stable in the past 10 years, depicting modest growth. This region boasts some of the world’s top tire manufacturers including Michelin, Continental, and Pirelli. However, it has faced serious challenges of high competition from low-cost tire producers in Asia.

The European market size attained 423.6 Million Units in 2022, having an estimated sales revenue of $43.5 billion. Based on the forecast, it’s anticipated to hit 503.5 Million Units by 2028. This depicts a 3.11% growth rate between 2023 and 2028.

Middle East and Africa

Finally, in the last 10 years, the Middle East and Africa demonstrated moderate growth in their tire sales. The growth in this region is attributed to the expansion of automotive industries in some major countries. These countries are Saudi Arabia and the United Arab Emirates.

Africa and the Middle East tire market is evaluated to have had over 110 Million units as of 2022. This is expected to continually grow at more than 10% CAGR in terms of value between 2022 and 2027.

The tire sales were estimated at around $24 billion in 2022. It is also important to note that Saudi is the largest market in the Middle East and Asia.

In summary, Asia-Pacific is leading with rapid growth while North America demonstrated consistent expansion. The European region depicted stable growth while the Middle East and Africa exhibited modest increases.

Major Players in the Global Tire Industry

Over the last decade, some key players in the global tire industry have maintained their position. They have also expanded their market presence. They include Michelin, Continental, Bridgestone, Goodyear, Pirelli, Sumitomo, and Yokohama.

Micheline Group

The Michelin Group has maintained its position as the strongest contender in the tire market. The tire giant focuses on high-tech features and innovative tire designs. Its consistent commitment to sustainability and minimizing its carbon footprint is noteworthy.

In 2022, Michelin generated a total sales of $30.31 billion.

Bridgestone Corporation

Bridgestone Corporation is another global leader in the tire industry. This tire giant offers various innovative solutions that meet the constantly evolving demands in the tire industry.

This manufacturer has a strong presence in different markets globally with its high-quality products and large sales network. Bridgestone generated a total sales revenue of $27.54 billion in 2022.

Goodyear Tire and Rubber

The Goodyear Tire and Rubber Company has not just been a reliable choice for buyers in the USA, it is earning global fame. Its innovative prowess has enabled the manufacturer to maintain a competitive position worldwide.

The Goodyear Tires and Rubber Company closed a net sales of $20.80 billion in 2022. The tire segment sales were $17.88 billion in 2022.

Remember that this sales revenue also includes Falken, Dunlop, and some other tire brands including Cooper, Mastercraft, Roadmaster Tires, etc. This is because they are currently owned by Goodyear. Sumitomo Group also has shares in Dunlop and Falken Tires.

Continental AG

Continental AG is famous for pushing the envelope in sophisticated tire technology. This manufacturer boasts a fantastic lineup of products for diverse applications, including specialty vehicles, commercial vehicles, and two-wheelers.

Continental AG’s consistent quest for improved fuel economy and performance has seized buyers’ attention. The manufacturer earned a net sales of $41.78 billion in 2022. Meanwhile, the tire sales volume was about $14.85 billion.

Pirelli Tyre

It is impossible to overlook Pirelli Tyre S.p.A. This Italian manufacturer has maintained a solid presence in the market’s high-performance tire segment, especially in the motorsports industry.

Pirelli manufactures a wide range of top-notch high-quality tires for all vehicle types. The company earned a total of $6.62 billion in 2022.

Sumitomo Rubber Industries

The Japanese conglomerate, Sumitomo Rubber Industries Ltd. has consistently made waves in the industry. The manufacturer offers a peculiar combination of sophisticated materials and innovative designs to actualize optimal tire performance.

Sumitomo Rubber Industries closed a net sales of $7.36 billion in 2022. Meanwhile, the tire sales revenue was $6.3 billion. Tire sales account for about 85% of the total sales.

Yokohama Tire

Yokohama Tire is another major player in the global tire market. The manufacturer has a consistently growing portfolio of both commercial and consumer tires. This tire manufacturer is famous for providing premium quality tires at affordable prices compared to other top tire brands.

The company earned a total of $5.76 billion in 2022. Meanwhile, the contribution from tire sales was around $5.05 billion.

Lastly, other companies like Toyo, Kumho, and Hankook have gradually boosted their global market presence. Their strengths, such as high quality, affordability, and high-performance options set them apart.

Collectively, these key players in the tire industry have been pacesetters in offering reliable and innovative tire solutions. Undoubtedly, their continuous growth and progress will eventually influence trends in the coming years.

The sales volume data above are converted to US dollars from the distinct currency stated on the source websites.

Global Tire Market Segmentation And Analysis

The global tire market can be classified based on various factors. This includes vehicle types, tire design, sales channels, original equipment manufacturer (OEM) and replacement tires, and emerging technologies that influence tire sales.

By Vehicle Type

When it comes to vehicle types, the global tire market can be subcategorized into:

- Passenger cars including CUVs and SUVs

- Commercial vehicles including buses and trucks

- Light commercial vehicles like trucks and vans

- Racing cars

- Motorcycles

- Aircraft

Over the last decade, various vehicle types have significantly influenced tire sales trends. For instance, the passenger car segment, which includes sedans, CUVs, and SUVs, has demonstrated robust growth. This happens to be a driver of a significant part of the overall tire sales.

Commercial vehicles (buses, trucks, and light commercial vehicles) have also played a role in tire sales trends evolution. The world has consistently depended on transportation as a means of moving people and products. This alongside the advancements in logistics and e-commerce has increased the need for commercial tires.

Besides the typical road vehicles, some other specialized vehicles like motorcycles have impacted tire sales. For instance, more commuters rely on motorcycles for convenient migration and affordability. This in turn has caused the motorcycle tire market to experience continuous expansion over the years.

Furthermore, the aircraft tire market has experienced some growth. However, the growth has happened at a smaller scale compared to the boom in the automotive industry. The demand for durable/reliable tires capable of handling the rigor of takeoff, landing, and taxiing has increased. This is due to the expansion of global air travel and the increase in fleet sizes.

By Design

There are two major designs in the automotive tire industry. They are radial and bias tire designs. Radial tires control the majority of the market share because of their efficiency and superior performance. Radial tires are mostly preferred for passenger vehicles.

Nevertheless, bias tires still hold a share of the market, particularly in heavy-duty agricultural vehicles and off-roading applications.

Fact.MR, a global market research and competitive intelligence provider reveals that the global bus and truck radial tire market stood at $16.77 billion as of 2023. It is expected to rise at a 6% CAGR to reach $30.03 billion by 2033.

The bias tire market size, on the other hand, is projected to expand at a 13.46% CAGR from 2022 – 2027. Meanwhile, a forecast reveals that the market size is expected to reach $25.76 billion by 2027.

Radial tires come with a unique advantageous technology and design compared to their counterpart, bias tires. They are built with steel belts casing that run radially from the tire’s center. The feature allows for better comfortability and an extended tread service life.

Conversely, bias tires’ casings are made up of layers of polyester or nylon beneath the tread, placed at a diagonal angle to each other. This design leads to a stiffer sidewall, offering increased durability but somewhat uncomfortable rides.

By Season and Terrain

Let’s explore the differences between summer, winter, all-season, and ultra-high-performance tires, as well as their features and functions. Firstly, winter tires are manufactured for use in cold and icy conditions.

They are built with more aggressive tread patterns and softer compounds. They provide better grip under low temperatures.

On the other hand, summer tires are ideal for warmer weather. They come with shallower treads and firmer compounds. With this, they offer fantastic handling and better fuel efficiency.

Meanwhile, all-season tires operate as a compromise between both. They provide optimum performance in different weather conditions. Finally, high-performance tires are designed mainly for racing vehicles and sports cars.

The market size, share, and growth of each of these tire segments differ regionally and globally. For example, winter tires sell more in regions with major seasonal changes such as Europe, North America, and Russia.

Conversely, users in regions that experience milder climates will most likely patronize all-season tires. It is vital to note that all-season tires have the largest market share on a global scale.

All-terrain, Off-road, industrial, and agricultural vehicle tires are designed to handle specialized tasks in different terrains. These tires usually have stronger sidewalls and deeper treads to tackle the challenging conditions they encounter in their peculiar applications. Examples of such challenges include rough surfaces, rocky terrains, construction sites, or muddy fields.

OEM vs Replacement Tires

The global tire market can also be categorized into two: replacement tires and original equipment manufacturer (OEM) tires. While OEM tires come fitted in new vehicles, replacement tires are bought separately.

Over the past decade, replacement tires have taken a larger share of the market than OEM tires. This is because of the increasing ownership of vehicles and the normal wear and tear of tires. These in turn result in a higher demand for tire replacements.

Sales Channel (Online vs Offline Tire Sales)

Over the past decade, there seems to have been a major shift in the manner in which consumers buy tires. With the ever-increasing internet penetration and popularity of e-commerce, we’ve seen significant growth in tire sales online.

Conversely, offline tire sales have ceased to dominate the global market.

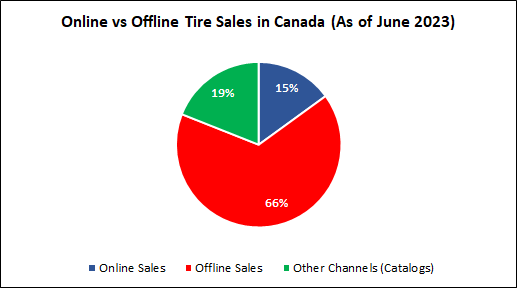

North America’s tire market is quite mature and established. Europe is just behind the USA while Asia-Pacific, Middle-East, and Africa are still in their initial stages of online tire sale and purchase trends.

In the last 20 years, several online tire merchants have emerged in the USA. They include famous platforms like Discount Tire, Tire Rack, Walmart, etc.

In the United States, in-store purchase still maintains its position as the most common tire sales channel. During the first half of 2023, about 78% of tire sales occur at a physical retail shop, while 12% of purchases happen online. The other 10% of tire sales come from alternative channels like catalogs.

Meanwhile, in Canada, online tire sales seem to be more popular than U.S. In-store sales account for about 66%, while online tire sales maintain around 15% of total purchases.

From a futuristic standpoint, forecasts predict that there’s a tendency for rapid growth of online tire sales in the coming years. This growth is predicted to potentially surpass offline sales soon.

The Rising Trend of Electric Vehicles

In the past decade, we’ve seen a quantum leap in the trend of both autonomous and electric vehicles. This new trend has a significant impact on the eco-friendly tire sales market.

Electric vehicles (EVs) have continually gained traction, with significant and ever-increasing sales figures in recent times. EV markets demonstrated exponential growth with sales exceeding 10 million units in 2022.

About 14% of the total number of new cars sold in 2022 globally were electric cars. Electric car sales were expected to continually rise through 2023.

In the first quarter of 2023, more than 2.3 million electric cars were sold. This figure is about 25% more than the same within the same period in 2022.

The Impact of Raw Materials On Tire Sales

Developments in materials have significantly affected tire sales trends in the last decade. Rubber is the primary raw material used in producing tires. The two main types are natural rubber and synthetic rubber.

In the past, natural rubber was the dominant material in tire production. Conversely, there has been a shift in the market in recent times due to the rise of synthetic rubber.

Apart from rubber, other important materials used in tire production include silica, elastomers, carbon black, and steel. Silica and carbon black are essential for enhancing the tire’s wet road performance.

Meanwhile, elastomers play a vital role in delivering flexibility and elasticity. Lastly, the steel belts in the tire structure help to enhance stability, comfortability, and strength.

One significant trend is the increasing use of silica. It helps to increase wet traction, reduce rolling resistance, and improve fuel efficiency.

What more? Advancements in tire manufacturing technology have introduced alternative, sustainable bio-based compounds like sunflower oil derivatives. They contributed to reduced CO2 production.

As tire manufacturers continually embrace eco-friendly manufacturing practices, there’s a tendency for the demand for tires produced from sustainable materials to surge.

Conclusion

In recent times, tire sales trends have depicted positive changes in the automotive market worldwide. We’ve observed that technological advancements and an increase in vehicle purchases have significantly increased tire sales globally.

Tire manufacturers ensured to adapt their strategies to meet the evolving demands. Overall, the growth of the tire market is significant and the future predictions are positive in all ramifications.